So we are into week 2, and for this week’s money talk, we will be discussing how to set a personal budget for college students. Yes, a personal budget, because why in the universe don’t you have one? Managing your finances is crucial, especially as a college student navigating through various expenses such as tuition, textbooks, and living costs. As a young adult, you know it’s essential to start getting on your money game and staying smart when it comes to your finances. Creating a budget allows you to track your income and expenses, set financial goals, and prioritize your needs over wants. This practice not only helps you avoid debt but also fosters good habits that will benefit you well beyond your college years. So let’s move into the steps you can take to establish a practical and effective budget that will empower you to make informed financial decisions.

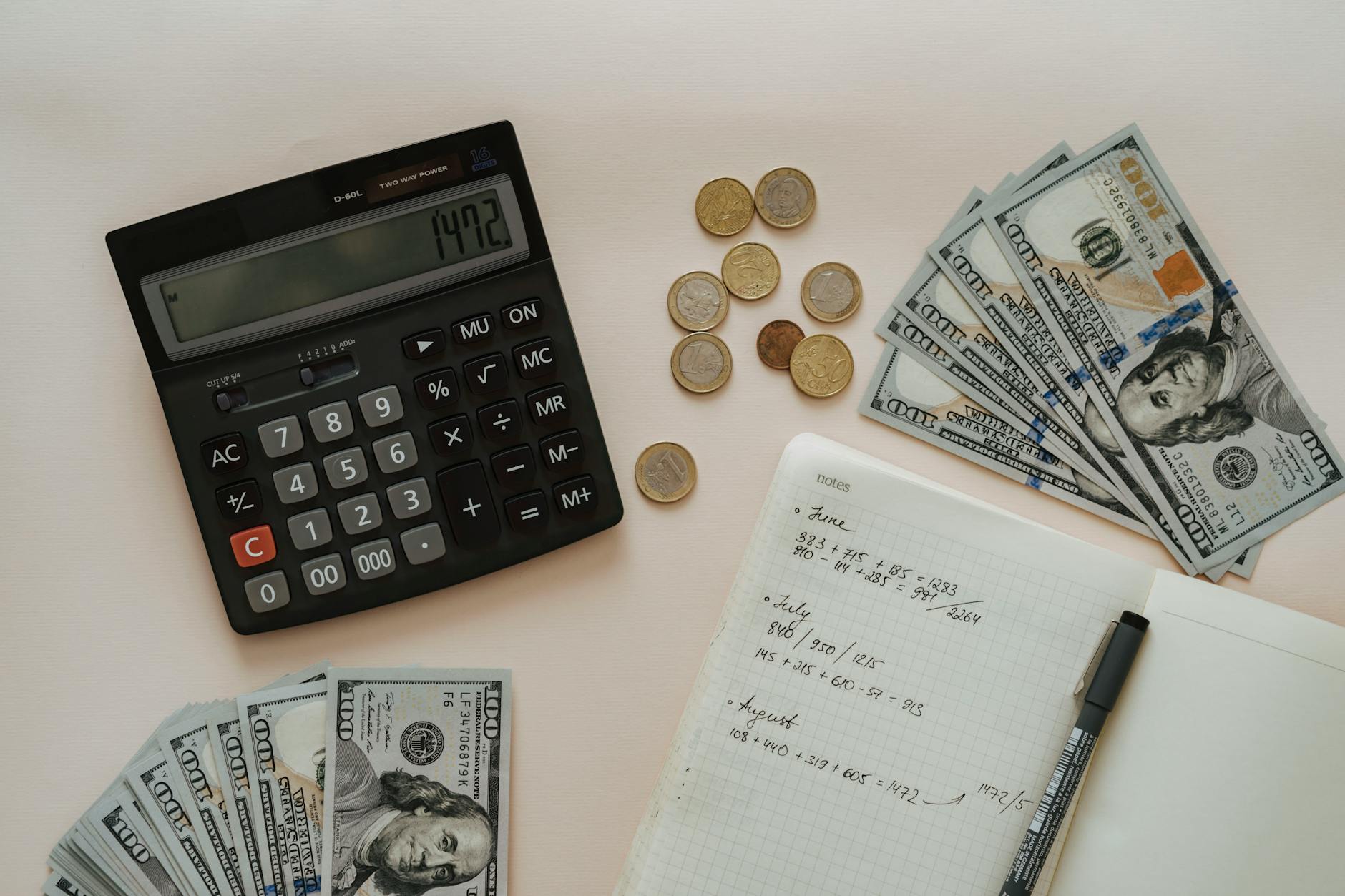

First thing first, let’s find out how much you make each month. This amount you make each month is called your monthly wage or gross income. You might have income from various sources, such as part-time jobs, internships, or financial aid. Be sure to account for all of these income streams when calculating your total monthly income. This will give you a clearer picture of your financial situation and help you understand how much money you have to work with.

Now that you have determined your monthly income, the next step is to list all of your expenses for each month. Take a moment to think about your regular expenses that you incur on a monthly basis. Do you pay rent or mortgage? Place it on the list along with the amount you pay each month. This is usually your largest expense, so it’s essential to account for it accurately. Do you pay cell phone bills? Put it on the list along with the amount paid each month. Do you pay for internet? Put it on the expense list along with the amount paid. Do you pay for groceries? Put it on the list along with how much you allocate towards it weeklyand monthly . We will repeat this process until you have listed all your expenses.

Additionally, consider other bills such as gym service, utilities, and insurance. These can vary significantly, so be realistic about your typical spending in these areas to avoid surprises later.

Next, include your educational expenses such as tuition payments, textbooks, and supplies. If you have any educational loans or fees associated with your college, make sure to note those as well. Don’t forget to budget for food, transportation, and entertainment. These smaller expenses can add up quickly, so track them diligently. You might also want to create separate categories for discretionary spending, which can include going out to eat, shopping, or other leisure activities.

Once you have compiled a comprehensive list of all your income and expenses, it’s time to analyze the numbers. Compare your total income to your total expenses. If your income exceeds your expenses, congratulations! You may have some extra cash to save or invest. If your expenses outweigh your income, it’s crucial to identify areas where you can cut back. Look for non-essentials or subscriptions that you can eliminate temporarily. This step is essential for maintaining financial health throughout your college years.

Creating a budgeting tool, such as a spreadsheet or using budgeting apps, can also help streamline this process. These tools make it easier to visualize your financial situation and track your spending over time. Some popular apps even allow you to set spending limits per category. Regularly updating your budget will keep you accountable and help you stay on top of your financial goals. Remember, a budget is a living document; it can and should change as your income and expenses evolve. By cultivating this practice, you’re not just preparing for college but for a financially stable future. Stay smart, stay organized, and let your budget guide you toward making sound financial decisions!

Now sticking to said budget is a different story. Life happens, and unexpected situations can arise, such as car accidents or theft, and so on. To ensure you’re prepared for these occurrences, consider doing some side gigs to boost your savings for emergencies. Side gigs not only help to increase your income but also give you valuable experience that could help with future job prospects. So what are some of the side gigs to do as a college student to help you boost up your savings account? Well…thats a topic for another blog post. Look foward to seeing it

Anyways, thanks for reading, and have a fantastic day! Goodbye for now.

#money #college #budgeting

- What is good about having a pet?

What is good about having a pet? What is good about having a pet? Well it is good because our family cat daughter and niece is a kind and good and listens sometimes beauty who is cute. She keeps the grandparents… Read more: What is good about having a pet?

What is good about having a pet? What is good about having a pet? Well it is good because our family cat daughter and niece is a kind and good and listens sometimes beauty who is cute. She keeps the grandparents… Read more: What is good about having a pet? - Do you need time?

Do you need time? Do I need time? Don’t we all need time? I don’t have time right now so I will make this short. Yep we all need time.. I don’t have time to do much today do here is… Read more: Do you need time?

Do you need time? Do I need time? Don’t we all need time? I don’t have time right now so I will make this short. Yep we all need time.. I don’t have time to do much today do here is… Read more: Do you need time? - What will your life be like in three years?

What will your life be like in three years? What will my life be like in three years? I don’t really know. I don’t even know what it will be like in 3 weeks from now. I have set a lot… Read more: What will your life be like in three years?

What will your life be like in three years? What will my life be like in three years? I don’t really know. I don’t even know what it will be like in 3 weeks from now. I have set a lot… Read more: What will your life be like in three years? - Invent a holiday! Explain how and why everyone should celebrate.

Invent a holiday! Explain how and why everyone should celebrate. Invent a holiday? Then explain how and why everyone should celebrate it? Well I don’t know so I guess I will be skipping this part. Thank for reading humans and animals… Read more: Invent a holiday! Explain how and why everyone should celebrate.

Invent a holiday! Explain how and why everyone should celebrate. Invent a holiday? Then explain how and why everyone should celebrate it? Well I don’t know so I guess I will be skipping this part. Thank for reading humans and animals… Read more: Invent a holiday! Explain how and why everyone should celebrate. - What alternative career paths have you considered or are interested in?

What alternative career paths have you considered or are interested in? What alternative career paths have I considered or are considering? Well my career major is business management but I am currently taking electrical engineering apprenticeship classes and thinking about actually… Read more: What alternative career paths have you considered or are interested in?

What alternative career paths have you considered or are interested in? What alternative career paths have I considered or are considering? Well my career major is business management but I am currently taking electrical engineering apprenticeship classes and thinking about actually… Read more: What alternative career paths have you considered or are interested in? - What food would you say is your specialty?

What food would you say is your specialty? What would I say is my specially? Huh? Um….I don’t know to be honest. I have no clue. So yeah. Thanks for reading humans and animals and non fallen angels and have a… Read more: What food would you say is your specialty?

What food would you say is your specialty? What would I say is my specially? Huh? Um….I don’t know to be honest. I have no clue. So yeah. Thanks for reading humans and animals and non fallen angels and have a… Read more: What food would you say is your specialty? - What historical events do you remember?

What major historical events do you remember? What historical events do I remember? Well I remember a lot of historical events but the one I can instantly remember is the event of 911. Why? Because my parents made a big deal… Read more: What historical events do you remember?

What major historical events do you remember? What historical events do I remember? Well I remember a lot of historical events but the one I can instantly remember is the event of 911. Why? Because my parents made a big deal… Read more: What historical events do you remember? - What makes a good neighbor?

What makes a good neighbor? What makes a good neighbor? Well a good neighbor is someone who cares like the good Samaritan in the new testments of the holy Bible. Why because Jesus said he cared for others even a distant… Read more: What makes a good neighbor?

What makes a good neighbor? What makes a good neighbor? Well a good neighbor is someone who cares like the good Samaritan in the new testments of the holy Bible. Why because Jesus said he cared for others even a distant… Read more: What makes a good neighbor? - Which topics would you like to be more informed about?

Which topics would you like to be more informed about? What topics would I like to be more informed about? More things to do with Christianity and what not. Why? Because i am a Christian. But in other news today. I… Read more: Which topics would you like to be more informed about?

Which topics would you like to be more informed about? What topics would I like to be more informed about? More things to do with Christianity and what not. Why? Because i am a Christian. But in other news today. I… Read more: Which topics would you like to be more informed about? - What are you doing this evening?

What are you doing this evening? What am I doing this evening? Well I don’t really know. Maybe sew somethings for myself or my online shop. I don’t know. Maybe have dinner. I don’t know. Maybe draw and write for my… Read more: What are you doing this evening?

What are you doing this evening? What am I doing this evening? Well I don’t really know. Maybe sew somethings for myself or my online shop. I don’t know. Maybe have dinner. I don’t know. Maybe draw and write for my… Read more: What are you doing this evening?

Leave a reply to Jackie120 Cancel reply